INDIAN REAL ESTATE MARKET OVER VIEW

INDIAN REAL ESTATE MARKET OVER VIEW

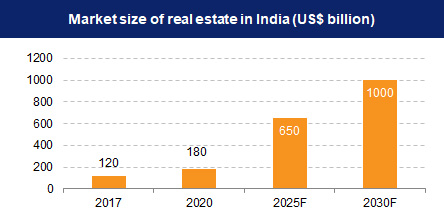

By 2040, the real estate market will grow to Rs. 65,000 crore (US$ 9.30 billion) from Rs. 12,000 crore (US$ 1.72 billion) in 2019. Real estate sector in India is expected to reach US$ 1 trillion in market size by 2030, up from US$ 200 billion in 2021 and contribute 13% to the country’s GDP by 2025. Retail, hospitality, and commercial real estate are also growing significantly, providing the much-needed infrastructure for India's growing needs. India’s real estate sector is expected to expand to US$ 5.8 trillion by 2047, contributing 15.5% to the GDP from an existing share of 7.3%. In FY23, India’s residential property market witnessed with the value of home sales reaching an all-time high of Rs. 3.47 lakh crore (US$ 42 billion), marking a robust 48% year-on-year increase. The volume of sales also exhibited a strong growth trajectory, with a 36% rise to 379,095 units sold. Indian real estate developers operating in the country’s major urban centers are poised to achieve a significant feat in 2023, with the completion of approximately 558,000 homes. In 2023, demand for residential properties surged in the top 8 Indian cities, driven by mid-income, premium, and luxury segments despite challenges like high mortgage rates and property prices. India's physical retail landscape is poised for a substantial boost, with nearly 41 million sq. ft of retail developments set to be operational between 2024 and 2028 across the top 7 cities, encompassing projects in various stages from construction to planning. For the first time, gross leasing in India's top seven markets surpassed the 60 million sq ft mark, reaching an impressive total of 62.98 million sq ft, marking a substantial 26.4% increase compared to the previous year. Notably, the December quarter emerged as the busiest quarter on record, with gross leasing hitting 20.94 million sq ft. Technology companies held the highest share in leasing activity at 22% during first quarter of 2024.Engineering and manufacturing (E&M) companies accounted for 13%, and banking, financial services and insurance account for 12%. Flexible space operators increase by 48%, showcasing their notable contributions. According to Savills India, real estate demand for data centers is expected to increase by 15-18 million sq. ft. by 2025. In 2023, office absorption in the top seven cities stood at 41.97 million Sq. ft. and Gross Leasing Volume is at 62.98 million sq. ft. Fresh real estate launches across India’s top seven cities grabbed a 41% share in the first quarter of 2023 (January-March), marking an increase from the 26% recorded in the same period four years ago. Out of approximately 1.14 lakh units sold across the top seven cities in the first quarter of 2023, over 41% were fresh launches. In 2021-22, the commercial space was expected to record increasing investments. For instance, in October 2021, Chintels Group announced to invest Rs. 400 crore (US$ 53.47 million) to build a new commercial project in Gurugram, covering a 9.28 lakh square feet area. The transactions of commercial real estate doubled and reached 1.5 million sq. ft. in Q1 of 2023. According to the Economic Times Housing Finance Summit, about three houses are built per 1,000 people per year compared with the required construction rate of five houses per 1,000 population. The current shortage of housing in urban areas is estimated to be ~10 million units. An additional 25 million units of affordable housing are required by 2030 to meet the growth in the country’s urban population. Indian real estate sector has witnessed high growth in the recent times with rise in demand for office as well as residential spaces. The Private Equity Investments in India’s real estate sector, stood at US$ 4.2 billion in 2023. The Private Equity Investments in India’s real estate sector, stood at US$ 3.4 billion in 2022. India’s real estate sector saw a three-fold increase in foreign institutional inflows, worth US$ 26.6 billion during 2017-2022. Exports from SEZs reached US$ 157.2 billion in FY23 and grew ~28% from US$ 133 billion in FY22. In July 2021, the Securities and Exchange Board of India lowered the minimum application value for Real Estate Investment Trusts from Rs. 50,000 (US$ 685.28) to Rs. 10,000-15,000 (US$ 137.06 - US$ 205.59) to make the market more accessible to small and retail investors. Construction is the third-largest sector in terms of FDI inflow. FDI in the sector (including construction development & activities) stood at US$ 60.53 billion from April 2000-March 2024. Some of the major investments and developments in this sector are as follows: Government of India along with the governments of respective States has taken several initiatives to encourage development in the sector. The Smart City Project, with a plan to build 100 smart cities, is a prime opportunity for real estate companies. Below are some of the other major Government initiatives: The Securities and Exchange Board of India (SEBI) has given its approval for the Real Estate Investment Trust (REIT) platform, which will allow all kind of investors to invest in the Indian real estate market. It would create an opportunity worth Rs. 1.25 trillion (US$ 19.65 billion) in the Indian market in the coming years. Responding to an increasingly well-informed consumer base and bearing in mind the aspect of globalization, Indian real estate developers have shifted gears and accepted fresh challenges. The most marked change has been the shift from family-owned businesses to that of professionally managed ones. Real estate developers, in meeting the growing need for managing multiple projects across cities, are also investing in centralized processes to source material and organize manpower and hiring qualified professionals in areas like project management, architecture and engineering. The residential sector was expected to grow significantly, with the central government aiming to build 20 million affordable houses in urban areas across the country by 2022, under the ambitious Pradhan Mantri Awas Yojana (PMAY) scheme of the Union Ministry of Housing and Urban Affairs. Expected growth in the number of housing units in urban areas will increase the demand for commercial and retail office space. The current shortage of housing in urban areas was estimated to be ~10 million units. An additional 25 million units of affordable housing are required by 2030 to meet the growth in the country’s urban population. The growing flow of FDI in Indian real estate is encouraging increased transparency. Developers, in order to attract funding, have revamped their accounting and management systems to meet due diligence standards. Indian real estate was expected to attract a substantial amount of FDI with US$ 8 billion capital infusion by FY22. References: Media Reports, Press releases, Knight Frank India, VCEdge, JLL Research, CREDAI-JL, Union Budget 2021-22, Union Budget 2023-24Market Size

Investments/Developments

Government Initiatives

Road Ahead